Staking built for real usage, not speculation

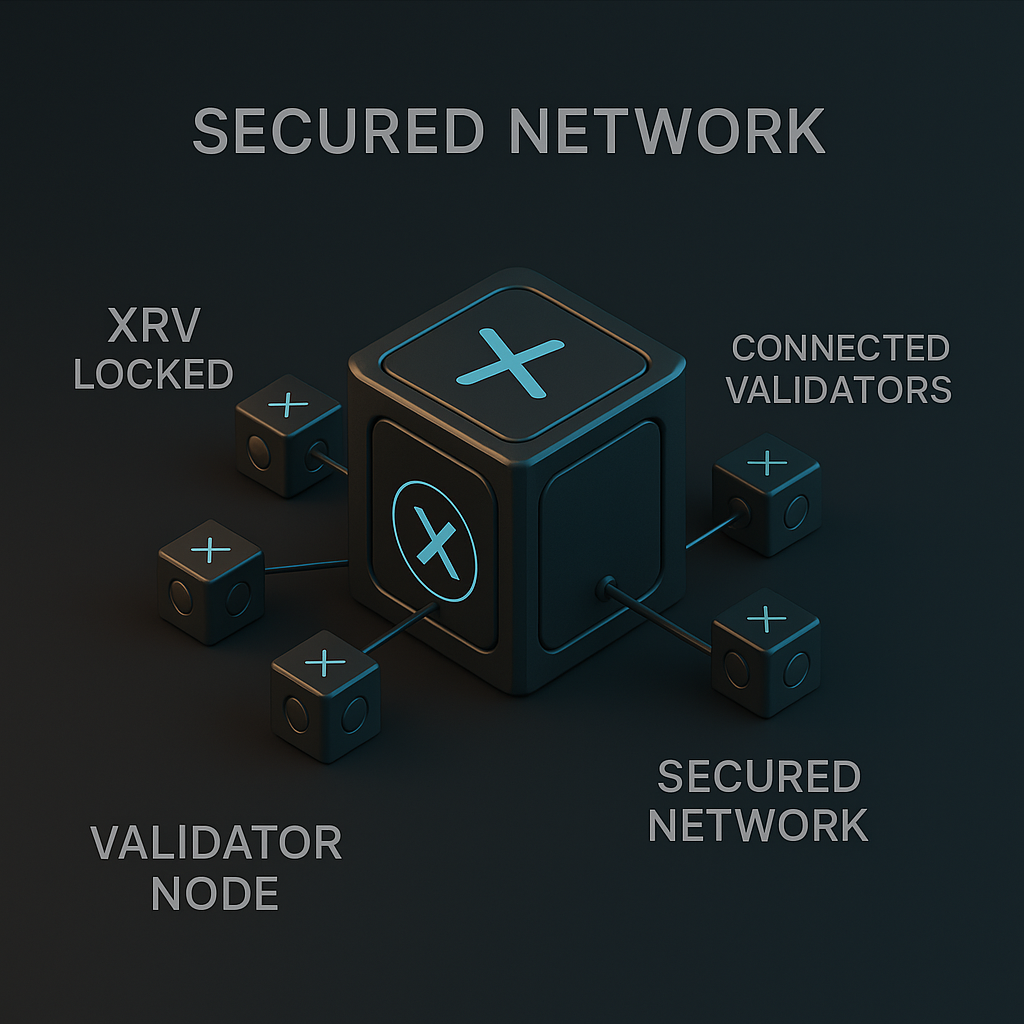

Xarva is a Tier-1 Layer-1 blockchain for real-world settlement. Validators lock XRV and run secure nodes that keep the network reliable for telecom and enterprise transaction flows.

- • Validators lock XRV and run nodes that secure the chain

- • The focus is reliability and rules, not headline APYs

- • Future delegators can support validators without hardware

Why staking matters on Xarva

Staking keeps the network strong enough for real settlement volume. Validators help order transactions, protect against attacks, and keep blocks flowing for telecom, enterprise and other large-scale settlement workloads.

- • Support real-world settlement flows, not just DeFi

- • Keep the chain online, fast and predictable

- • Help ensure transactions are ordered and finalised

- • Provide security that enterprises can rely on

Validators today (institutional first)

Early stages of Xarva focus on professional operators who can meet Tier-1 expectations for uptime, security and compliance. These are the first group trusted with securing real settlement flows.

- • Run validator and settlement nodes

- • Maintain strong key management and monitoring

- • Coordinate on upgrades and incident response

- • Align with clear operational and policy guidelines

Delegation (future phases)

Over time, Xarva may let token holders support validators without running hardware. Any delegation model will be designed to stay simple to understand and aligned with regulatory needs.

- • Delegate XRV to vetted validators

- • View performance and basic risk indicators

- • Adjust delegation based on preferences

- • Always subject to protocol and legal frameworks

Risk and safeguards

Staking always involves risk. Xarva is designed with clear rules and safeguards, but it cannot remove market, technical or operational risk. Misbehaviour may lead to penalties.

- • Misbehaving validators may face slashing or removal

- • Network conditions and parameters can change over time

- • No guarantee of fixed yield, price or liquidity

- • Participants should assess their own risk tolerance

Compliance and staking

Xarva is built as a compliance-aware Layer-1. Staking and validator roles are meant to work alongside governance, policy and Travel Rule-style checks where required by law.

- • Validator policies can reference compliance requirements

- • Governance can update parameters in a transparent way

- • Staking flows are designed to be auditable end-to-end

- • Details live in the whitepaper and technical docs

Design goals for Tier-1 staking on Xarva

Xarva's staking model is built to meet Tier-1 expectations: strong security, simple mental models for non-technical users, and alignment with regulatory standards for large-scale settlement.

- • Prioritise network security, reliability and uptime

- • Keep roles and responsibilities clearly explained

- • Avoid over-promising yields, timelines or outcomes

- • Evolve parameters through open governance over time

All descriptions on this page are forward-looking design goals, not guarantees of future performance, rewards, market behaviour or regulatory outcomes. Staking may not be available in all jurisdictions and may be subject to additional legal and technical documentation.